We Only See a Version of the Truth

A few years ago, I attended a presentation by Terrance Odean, Berkeley Professor and famed researcher on behavioral finance. In the middle of his presentation, Professor Odean played a video and asked audience members to count the number of times the players in white shirts passed a basketball. I vigilantly went about the task, putting down my cell phone and Twitter to take part. As the three players in white weaved among three players in black, I had to concentrate to keep up with the number of passes. I wasn’t sure if I counted correctly when the 90 second video ended.

After the video, Professor Odean asks, how many of you saw the person in the gorilla outfit walk across the screen? I’m thinking – what gorilla? As half of the audience raises their hand to indicate they saw a person dressed as a gorilla in the video, I began to doubt my eyesight. He plays the video again, and lo-and-behold, when not busy counting the basketball dribbles, I see the gorilla. It blew my mind.

Christopher Chabris and Daniel Simons conducted the original “gorilla experiment” in 1999 at Harvard University. In the study, only half of participants reported seeing the gorilla. I’m relieved to know I am not alone. Chabris and Simons wrote on their findings:

The experiment reveals two things: that we are missing a lot of what goes on around us, and that we have no idea that we are missing so much.

Last week, I started a course in Behavioral Finance. It is an elective and one of the final two classes I need to complete a Masters in Personal Financial Planning. The main text is Daniel Kahneman’s Thinking, Fast and Slow. I read it several years ago, but I relish the opportunity to review it and write essays about it for two months.

Kahneman describes what your brain is doing when you are blind to the gorilla. He calls this System 2 thinking. System 2 is the part of our brain that requires effort and concentration to calculate, decipher, or process information. Its counterpart, System 1, is an automatic response to our surroundings. Kahneman describes System 1 as our ability to view a human face and instantly know the person is angry. System 2 kicks in when we attempt to multiply two double digit numbers. System 1 is fast, and System 2 is slow.

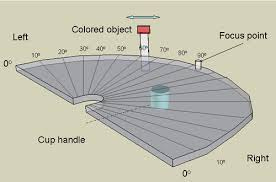

When I was in the New York office last month, Barry showed me an experiment to test peripheral vision. The test subject stands facing forward, while someone walks around their field of vision as if walking the three point line on a basketball court, holding an object of one solid color. I could not tell what color Barry was holding until he reached approximately 60 degrees in my line of vision.

We are walking around with a narrow range of vision, while our brain constructs the peripheral from information we’ve already stored. If we are in a new place, that mental construct is less accurate than in familiar surroundings. We think we see the full picture, but in reality, it’s an illusion.

How does this apply to investing? We must be honest with ourselves. There is a lot of information that we don’t know we don’t see. Some investors call these blind spots. In lab tests, Kahneman found that pupils dilate when humans are given a task that requires System 2 thinking. Pupils dilate to a greater degree as the task becomes more cognitively burdensome. This level of thinking can literally cause blindness to objects directly in our vision, like the gorilla. Keep this in mind as you walk about the Earth. We are all viewing our own narrow, limited version of the truth.

The post We Only See a Version of the Truth appeared first on The Belle Curve.