Last week, Morningstar published a report on the use of 529 accounts for college savings. It found that only 16% of families with young children are using 529 plans. While this number is not necessarily shocking, it is unfortunate that families are leaving money on the table. Morningstar’s report, authored by Head of Behavioral Science, Stephen Wendel, estimates that:

American families are leaving more than $237 billion on the table by not investing their college savings in 529s.

The report goes on to explain that a portion of the missed opportunity is attributable to tax benefits. But the overwhelming majority of this estimate is based on the missed opportunity of investing in markets. Not only are families not taking advantage of 529 accounts, they are putting the money in bank accounts earning low interest rates.

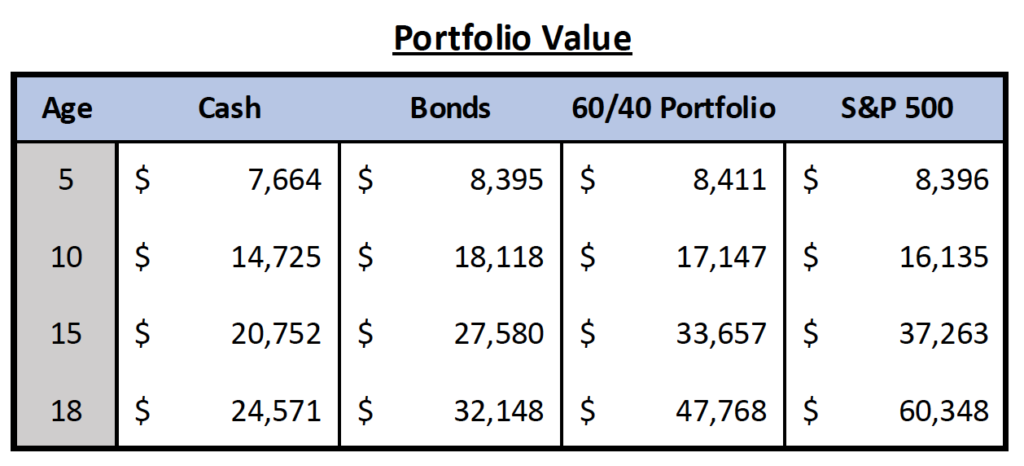

An 18-year-old high school senior today was born in 2000. During this student’s lifetime, the stock market has experienced two significant bear markets. Yet take a look at the dollar difference between cash savings and portfolios of stocks and/or bonds. This scenario assumes that a family saved $100 per month from birth in January 2000 to September 2018. The difference between saving in cash and a 60/40 portfolio is almost $24,000. That could pay for an entire year of tuition and room and board at a public in-state university.

* Illustration uses monthly returns of the One Month T-Bill, Bloomberg Barclays US Aggregate Bond Index, and the S&P 500 Index. The 60/40 portfolio is comprised of 60% S&P 500 Index and 40% Bloomberg Barclays US Aggregate Index. Savings assumed to be $100 per month at the end of each month.

The information gap on saving for college must be astronomical if most families don’t even invest their college savings. I wrote earlier that the landscape for saving and investing is too complicated, potentially resulting in seven different types of accounts. The administrative burden is a nightmare.

However, by not participating in a 529 plan to save for college, families are missing out on a good deal. Here’s a quick primer on the benefits and misconceptions about 529 plans.

529 Plans allow for “tax free” status for qualified tuition expenses. Contributions are made with after-tax dollars, like a ROTH IRA. Some states allow a small state income tax deduction for contributions. Earnings grow tax-deferred, and withdrawals are tax and penalty free for qualified education expenses.

Everyone is eligible to make contributions. Unlike ROTH IRAs, there are no income limitations on 529 plan contributions. Grandparents may also choose to fund 529 plans, which should be used to pay for tuition after the Junior year to avoid negative consequences for financial aid.

529 savings plans can be used to fund qualified education expenses at most colleges and universities. You are not required to spend the money in-state unless the plan is specifically a “pre-paid tuition” plan. Some foreign colleges and universities are also eligible.

You do not have to open a 529 account in your state of residence, although you will not receive state income tax credits for using another state’s plan. If you want the investment options in a different state, you are free to open an account.

The 2017 tax bill allows for 529 withdrawals up to $10,000 per year to pay for private K-12 tuition. In 2015, computers were added to the list of qualified expenses.

You do not need to go through a broker to invest. Broker-sold plans have high fees to account for the sales commissions. Most states offer direct to consumer plans, and most can be opened on your state’s website.

You must use 529 funds to pay for qualified education expenses, otherwise withdrawals are taxed and earnings are charged a 10% penalty. However, you can change the beneficiary of a 529 to any qualified family member and use the account to pay for their education expenses.

The cost of college is already through the roof and is increasing at a rate 2-3% higher than the inflation rate. Most families will use a mix of savings, grants, scholarships, loans, and payments from monthly cash flow to cover the bill. Don’t miss out on an opportunity to stretch your savings a little further through the tax benefits and market growth available in a 529 plan.