On Wednesday, President Trump stepped up to the podium in the Rose Garden and announced ‘reciprocal’ tariffs to be charged on goods imported from every trade partner in the world, and then some. In an event he called “Liberation Day,” the President presented his list of tariffs on a poster board reminiscent of a middle school science fair project. The announcement and Trump’s multi-decade belief in tariff policy were widely publicized and anticipated. However, the staggering size and scope of the tariffs were far beyond what market participants could have imagined in their wildest dreams.

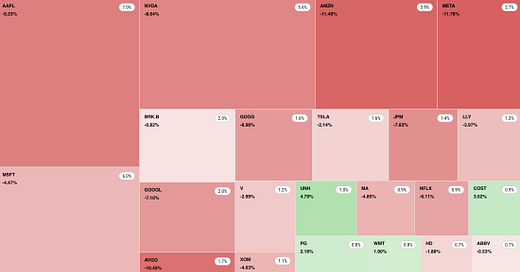

The markets spoke to this shock. US stocks were in free fall on both Thursday and Friday. The S&P 500 Index lost 10.5% over two days. The Nasdaq 100 lost over 11%. It was the fourth worst two-day stretch for US stock markets since 1950. I won’t sugarcoat it. This is bad.

What is a long-term investor to do?

Refrain from decisions made based on emotions. No good investment or trading decision ever comes under heated emotions. In times of fear, your brain latches on to negative information. It is easy to rationalize that things will get much worse for markets before they improve. They likely will, but here’s the thing ….

There are no magical strategies to avoid the pain. I wish I could tell you there’s a way to prevent the pain while still earning market returns. It is the most natural reaction in the world to want to do this. We know things are bad now, so why not sell out and wait for the smoke to clear? Because you have two chances of being wrong - when to sell and when to buy back in. It’s buying back in, which is harder. The market doesn’t wait for the news to get better. When the news improves, it’s too late. COVID is the perfect example. The stock market rally began in April 2020, long before the COVID death rate peaked and years before life returned to normal.

But this one is different. Every market sell-off is different. This isn’t my first rodeo, but it is the first self-inflicted and completely avoidable one. That is hard to reconcile. But so was the global pandemic that shut down the economy and the financial crisis that left the entire global banking system bankrupt on paper. The difference is that we know how past crises ended. We see they were amazing buying opportunities. It absolutely did not feel that way at the time. This crisis will also end.

Give yourself a pressure release valve. Everyone learns their true risk tolerance in a crisis. If you need to do something to release the pressure or sleep at night, consider more minor changes. Perhaps you can raise enough cash to cover a year of expenses and put it in a high-yield savings account. Or you can reduce your stock exposure from 80% to 60%. By all means, do something at the margins, but don’t sell out.

Invest Cash on the Sidelines. No one knows how long this will last or how deep it will be. But the best time to buy stocks is when they scare you the most. The data supports this. Potential returns in the next 1, 3, and 5 years increase as the selloff grows. If you have cash intended for long-term investment, now is the time to start putting it to work. You do not need to go all at once. Divide it into 1/3rds or 1/4ths and devise a plan to invest it over time or at key market levels.

Make a plan to rebalance. If you don’t have cash on the sidelines, there is still a way to take advantage of lower prices. Hopefully, you have some bonds in your portfolio. Calculate how far your allocation has moved from its target. Define a level at which you will sell bonds to buy more stocks. Will it be when your portfolio is 5, 10, or 20% off balance? The best time to plan is in advance. Then, stick to your plan no matter what. Discipline is probably the most important skill for the long-term investor.

No one knows the future. Not even the smartest pundits on TV. This crisis could end on Monday or stretch for years as an escalating trade war and global recession. Long-term investing requires optimism about the future. Companies will find a way to produce the goods and services we want and need and sell them at a profit - no matter how the new rules shake out. Your success never required knowing the future - only your fortitude to stick to your plan. Dorothy didn’t need the Wizard of Oz to take her home to Kansas. All she had to do was click her heels.

Take a deep breath. This could go on for a while. Settle in. Find whatever coping mechanisms work for you. I recommend turning off the TV and reducing your overall news consumption. I heard FoxNews took the market ticker off their screens mid-day on Thursday. Investment returns are earned, not given. I am reminded of one of my all-time favorite investing quotes:

In bear markets, stocks return to their rightful owners. - J.P. Morgan

Teach your readers about upside investing…It is a valuable technique to know….

Is it just me or is it normal to come to the realization that every best opportunity to buy arrives just when you do not have enough cash left over to do so! :-)