If you have cash sitting on the sidelines, this is the moment you were waiting for. You watched it go up, and now you’ve watched it come down. If not now, when?

Huge caveat, this is not a bottom of the market call. There are no models to quantify what happens when more than half of the world’s economy completely shuts down to combat a global pandemic of a new virus for which we have no immunity, no effective treatment, and no vaccine.

But, if the world is not ending. If you believe we can beat this disease. If you believe that people will pick up the pieces and continue their lives after the fog clears, then there is no point trying to pick the bottom of this market. Forward looking returns for stocks are higher than they have been since the Financial Crisis.

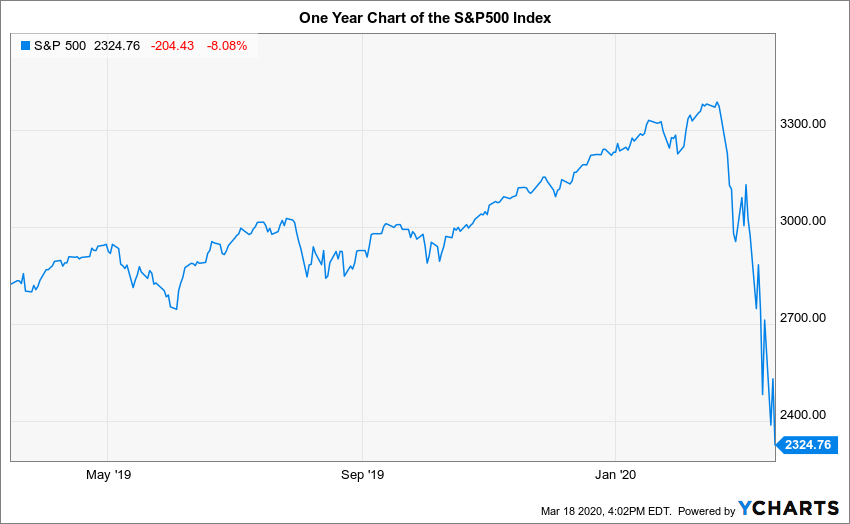

Stocks are down 30% in less than a month. Volatility is high, and the VIX has surpassed levels seen during the Great Financial Crisis. We can now begin to compare this selloff to the Crash of 1929, which is unthinkable. Last Thursday’s incredible 10% drop in U.S. stocks has already been awarded the moniker “Black Thursday”. But Thursday was quickly outdone by this Monday’s 13% decline. Wednesday, stocks took another, painful leg down, but ‘only’ 6%.

The best time to invest is when people are scared.

You probably won’t catch the bottom. Stocks could fall another 15%-20% or more from here. Since we cannot predict the direction or level of the stock market in the short-term, I like to practice what I call the ‘bird in the hand’ theory. Today we have a bird in our hand, the market just crashed 30% in less than a month. We couldn’t predict it in advance. Who could predict that the next global pandemic was lurking around the corner?

What we can do is take advantage of the bird we currently have in our hands.

Invest Cash on the Sidelines – Be prepared for immediate short-term losses if the market continues to sell off. No one can call the bottom with precision, and now is one of the best times to buy stocks since March 2009. These times don’t come around very often. They are also scary. Investing is not for the faint of heart.

Rebalance Your Portfolio – If the amount of stocks in your portfolio is lower than your original target, it is time to rebalance. You should sell some bonds and buy enough stocks to bring your portfolio back to its target. If the market falls further, you may need to rebalance a few more times before the worst is over. But this down market too shall pass. Make sure you own your target weighting to stocks when the market recovery begins.

Identify Opportunities for Tax Loss Harvesting – Some of your investments may be below their purchase price, the cost basis that is used to calculate capital gains tax. You can sell these securities, book a tax loss, and reinvest immediately in something similar. For example – sell the ABC S&P500 Index Fund and buy the XYZ S&P500 Index fund. Securities sold at a loss cannot be repurchased within 31 days to avoid the IRS ‘wash sale’ rule. If this seems too complicated, well, it is. Consider hiring an advisor or working with a roboadvisory firm that offers tax loss harvesting for a small fee.

Accelerate Savings – If you are able, increase your 401(k) savings to front load contributions for the year. The maximum employee contribution in 2020 is $19,500 ($26,000 if over age 50). You can make this contribution with your first paycheck, your last, evenly throughout the year, or at any time you choose. You should also consider front-loading 529 plan, IRA, ROTH IRA, and SEP IRA contributions. If you were considering a ROTH IRA conversion, now may be a good time to pull the trigger with stocks a lower prices.

Here are a few warnings about things you should NOT be doing with this bird in the hand.

Do NOT invest short-term money in the stock market. Something that has become crystal clear in the past few days is how woefully unprepared many Americans are for a short-term loss of income. Maintain a cash reserve of 3-6 months at a minimum.

Do NOT take more risk than appropriate for your financial plan or more than your risk tolerance allows.

Do NOT borrow money to invest. This includes margin and security backed loans.

I am sure there are other strategies, but these are a few highlights of what you can do with the current ‘bird in the hand’ bear market. It doesn’t matter when you invest but that you do invest, so you might as well jump on here.

If this really is the end, it won’t matter anyway.