In early March, with the stock market in free fall, my husband and I began discussing our investment plan. Even though it was a scary time, the stock market was on sale. With our long time horizon, we recognized a buying opportunity. He has nagged me for years about individual stock picks, but my stock picking days are long gone. As I accelerated contributions to our kids’ 529 plans and made sure we invested any extra cash laying around, he opened a small trading account at Robinhood.

Fine, I said, go ahead, but make sure you send copies of duplicate statements to our Chief Compliance Officer as we are required.

Market volatility in mid March was insane. He would rejoice looking at his account balance one day, then talk about selling everything the next. It was fascinating to watch him react, as I was also witnesssing a dictionary of behavioral finance subjects play out before my eyes.

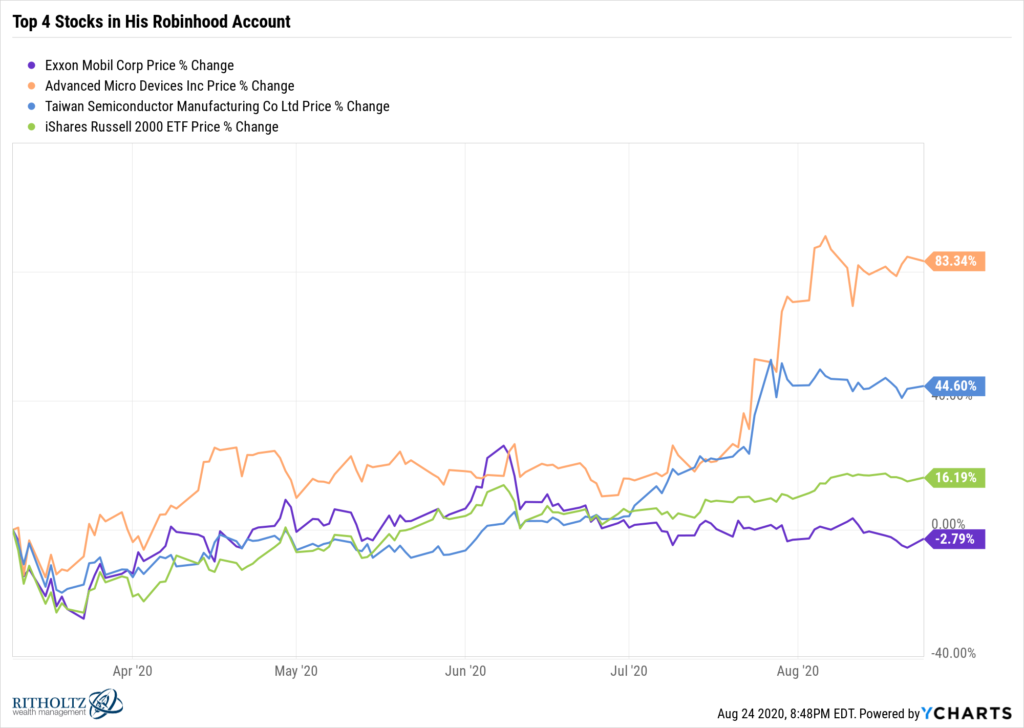

He had a brief encounter with value investing when he bought Exxon Mobil (XOM) more than 50% off its highs. But unlike traditional value investors, he wasn’t willing to stick with the pain and cut his losses. He has been a fan of Advanced Micro Devices (AMD) for years. Luckily he had time to jump on the AMD train, riding it to new all-time highs. Taiwan Semiconductor (TSM) also made on appearance in his portfolio, a big winner so far.

He also bought the small cap index (IWM). Small caps booked their worst quarter on record in March. I have to admit to being a little proud of his contrarianism here. When you combine this with his high flying momentum stocks, dare we say that he is ‘diversified’?

Rather than day trade, he has pretty much stuck to his strategy. There was a moment in late March where he went 40% to cash. He panicked a little, but didn’t sell everything. And he had the fortitude to buy back in to his highest conviction names.

He’s not following Dave Portnoy’s picks or the Robinhood list of top holdings. Most of these stocks are long-term holds. This is play money; money we can afford to lose if these stocks tank. Performance has been great so far, which makes it fun. After all, if you are going to dabble in a few individual stocks you should expect massive outperformance to compensate for the risk.

This is why I sometimes suggest that a client keep a small trading account. Stocks and companies are fun to follow, as long as there are guardrails in place. The account should be small enough that a complete loss wouldn’t materially impact their financial plan.

Performance of his tops picks since March 10, the day he opened his account. He sold Exxon early at a loss.

Sometimes it is fun to live a little. Just remember that speculation is different than investing. The potential outcomes are wider with speculation, and that includes both to the upside and the downside.

Unfortunately there is no way to calculate the portion of any investor’s returns that are attributable to luck versus skill, even for the greatest investors of all time. Staying humble enough to realize that luck plays a significant factor may be the key to coming home from the casino with some of your gains.