Recap: CFA Institute Asset and Risk Allocation Conference

The CFA Institute has finally resumed in-person conferences, and I was lucky to be invited to emcee the Risk and Asset Allocation conference last week in Washington D.C. Held at the Watergate Hotel, where the room keys cheekily read, “You don’t need to break in” on the back, the conference was a nonstop firehose of useful discussion on topics ranging from monetary policy to AI. I had a front-row seat for the entire event, making announcements, introducing speakers, and moderating the audience Q&A. It felt great to be back and to mingle with a fantastically diverse group of attendees. In true CFA fashion, I met investment pros from all corners of the world; including South Africa, Kansas, Canada, and even a few from the D.C. suburbs.

While I am just starting to digest the discussions from last week, here is a quick recap of my key highlights and takeaways.

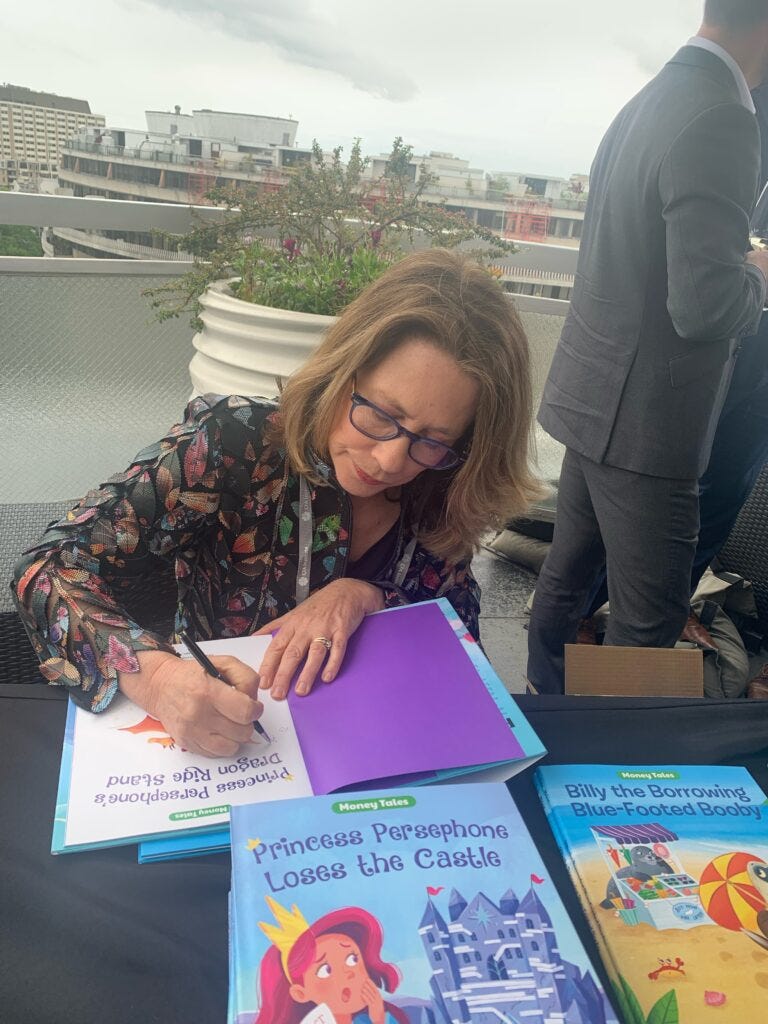

Former FDIC Chair (and children’s picture book author) Sheila Bair reflected on the recent banking crisis and collapse of First Republic Bank on Monday. She made two extraordinarily simple and obvious (in hindsight) comments; “guarantees should be explicit, not implicit,” i.e. insurance on deposits, and “it’s important to follow the rules as they are written” to instill trust in markets. She favors 100% insurance on the deposits in transaction-based accounts at banks that earn 0% interest but not for interest-bearing deposits in savings accounts. She signed copies of two books from her Money Tales series for my children, which I will treasure.

Former FDIC Chair Sheila Bair signs books from her children’s series, Money Tales

Sonny Kalsi, co-CEO of global real estate firm BentallGreenOak, told us that office occupancy rates are 110% in Asia, 80-90% in Europe, and 15% in the U.S. It seems we are the only ones who don’t want to return to the office post-pandemic. Furthermore, converting downtown office buildings into housing isn’t as simple as one might think. He estimates those buildings will have to sell for land value in order to profit on the cost to convert these properties. The real estate sector contributes more greenhouse emissions than the transportation sector and must play a role in emissions reductions if we have any chance of success.

Marco Papic of the Clocktower Group gave a masterclass in geopolitics as a framework for investment decision-making. He defined the newly popular term multipolarity as a world with more than one or two superpowers. The end of U.S. hegemony is made evident by the behavior of other countries, and China has no interest in facing off head-to-head with the U.S. for global domination, as they’d be sure to lose. But rather than present a doom and gloom scenario where we all decide to buy defense stocks and gold, he gave compelling examples of which parts of the global economy are likely to benefit and/or lost out in transitioning to a multipolar world.

Ashby Monk, the Head of Research at Addepar, likened the current tech we use to build portfolios to paper maps and made a case for how we will transition to using GPS to populate routes. He suggests we stop using Excel spreadsheets within five years <clutches pearls>.

Howard Marks joined us virtually from the west coast to discuss his thesis on Sea Change and why this is a pivotal market environment. He described how the end of a 40-year decline in interest rates ended in over a decade of ZIRP that was unnatural and led to TINA and FOMO investing. He believes there will be double-digit return opportunities in the credit sector to come from the current interest rate environment and even quipped, “Why do you even need stocks?” right now.

Interviewing Michael Mauboussin, Head of Consilient Research, Counterpoint Global, Morgan Stanley, was one of my highlights of the conference. I have long admired his ability to distill the sources of investment returns into a framework for decision-making. He explained that the relative amount of luck involved in investing – as opposed to high-skill activities like chess and even sports – provides both a challenge and opportunity for active investors. He noted that while active managers are pretty good at picking good investments, they do not properly size those positions in portfolios. In fact, managers would have performed better simply by equal weighting holdings, or even more deflating, by following their own set of rules for position sizing.

Interviewing Michael Mauboussin on the sources of success in active management

I loved that Marlena Lee, Head of Investment Solutions at Dimensional Fund Advisors, and Kai Wu, Founder of Sparkline Capital, treated their panel session as a debate on the use of data to make decisions. They were perfect debate partners. Kai’s research on the use of intangible assets (such as brand equity, intellectual property, and human capital) to value stocks and Marlena’s command of the data in traditional valuation led to a lively discussion. Is Kai truly onto something new by organizing unstructured data into new valuation models, or is this all simply ‘noise’ that feeds into market prices, as suggested by Marlena?

Lest you think this conference avoided crypto, I was pleased to moderate a session on digital assets with Eelco Fiole, of Alpha Governance Partners, and Chris Addy, President and CEO of Castle Hall. Chris brings a traditional due diligence perspective to investing in crypto assets – Spoiler Alert! – few can pass a traditional review of ‘belts and suspenders’ questions. Eelco is deeply involved in analyzing and advising on the proper governance structure for blockchain projects. After a thorough, and well-deserved, slaying of the failures of FTX from both a governance and due diligence perspective, Chris and Eelco provided real-world advice for investors considering the allocation of funds to this space.

The grand finale was a lesson on monetary policy from none other than Professor Jeremy Siegel of Wharton. He gave an impassioned speech on why the Fed was both late to react to inflation caused by the historic increase in money supply (M2) during the pandemic, but also painfully unaware of the impact their 500 basis point increase in policy rate is having on inflation. Using real-time data on housing prices (the Fed uses a metric that looks back 18 months), he believes inflation has recently turned negative, and the Fed is still raising rates. Afterward, Jeremy Schwartz, Global CIO of WisdomTree and co-author of the 6th edition of Stocks for the Long Run, and I joined Professor Siegel on stage for Q&A. We capped it off with Professor Siegel’s live reaction to last week’s Fed meeting, which came out as we were on stage. To call this a career highlight would be an understatement. I am still floating somewhere in the clouds from this experience.

Professor Jeremy Siegel gave a graduate-level lecture on monetary policy

A huge thank you to the CFA Institute, especially the Director of Events Programming, Julie Hammond, for inviting me to emcee and moderate this conference. It was an honor to be involved in planning the content and helping put on this fantastic return to in-person events from CFA. There is a place for erudite, informative, educational, and timely in-person content, and few organizations can match the CFA Insitute’s prowess in creating these types of events. I knew this from my conversations with attendees during breakfast, lunch, and networking sessions.

The post Recap: CFA Institute Asset and Risk Allocation Conference appeared first on The Belle Curve.