Should You Be Worried About the US Debt?

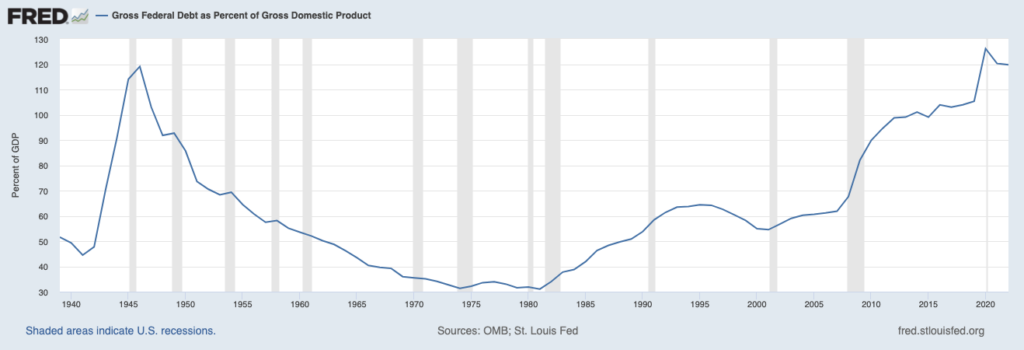

The size of the U.S. national debt is getting a lot of attention lately, and for good reason. Deficit spending through the COVID pandemic was enormous, pushing the total outstanding debt to a staggering $31 Trillion, with a T. A better way to measure the size of the debt is as a percentage of our annual economic output, GDP. That ratio has also surpassed the all-time high from WWII, topping out at more than 120% of GDP in 2020.

Source: St. Louis Fed

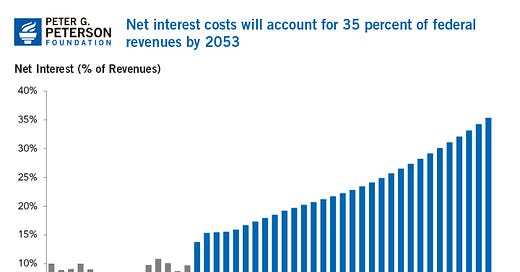

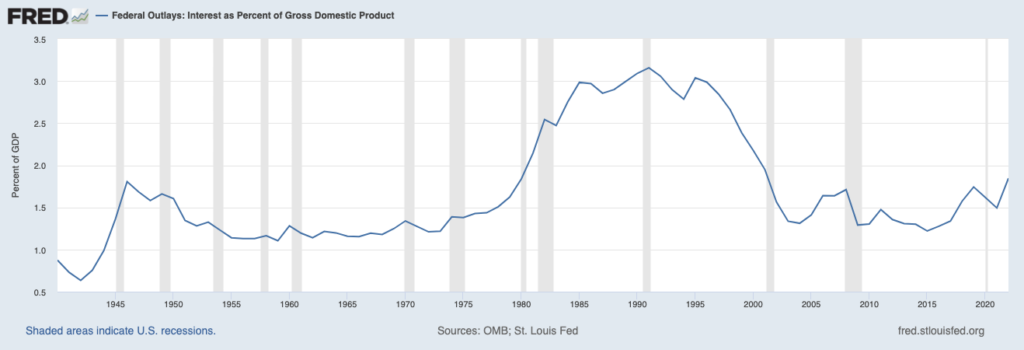

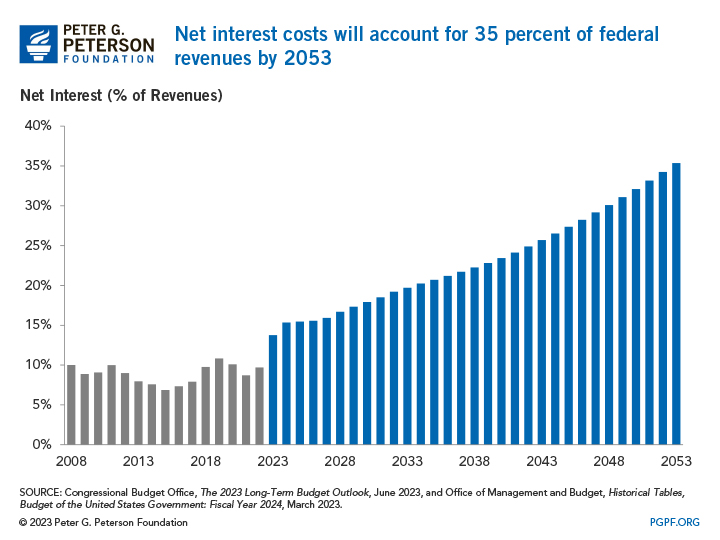

Other economists point to interest payments as a percentage of economic output. Here, the numbers are less alarming. Current payments are well below the highs of the 80’s and 90’s. But here’s a big caveat: the current debt was issued at historically low interest rates. And much of the debt will soon be refinanced at much higher rates. The Congressional Budget Office estimates that, on the current trajectory, net interest costs could account for 35% of Federal revenue by the year 2053. That is a scenario where we do nothing to change course. Thus, the recent Wall Street Journal articles and media attention on the national debt.

Source: St Louis Fed

There are past examples where too much debt pushed countries near or into bankruptcy, like Greece (2008), Argentina (2001 and 2020), Russia (1998), and Mexico (1982). These countries have significantly smaller economies than the US, and none of them enjoy the status of the world’s reserve currency, like the US Dollar. On the other hand, Japan’s debt is more than 250% of its GDP, and still borrows at extremely low rates.

The answer, unfortunately, is that the size of the US debt won’t matter until it does. There’s no way of knowing what amount or when that will be. It’s similar to asking, “How big is the universe?”. There are theories, but no definitive answer yet.

Debt and deficit hawks have existed since the nation’s founding, when debt from France and The Netherlands funded the Revolutionary War. Alexander Hamilton faced intense opposition to starting a national bank. Ironically, the only time in our history that the US debt was paid down was in 1837 by Andrew Jackson, and an economic depression followed. I am not claiming the correlation is causation here, but I find this nugget of history extremely interesting. (h/t to my colleague Ben Carlson for mentioning it on Animal Spirits).

Source: TreasuryDirect.gov

This is where the public argument about the debt and the deficit is confusing and borders on misleading. And yes, there’s a heavy dose of fearmongering and doomsdaying to go with it. Let’s be clear: the US will never actually pay off or likely even reduce the debt. Instead, the size of the economy, and therefore tax revenue, will grow to make the relative level of debt and interest payments more manageable over time. That’s what happened after WWII, and all other times, debt increased to fund a war or a crisis, with the exception of 1837.

What we can and likely will do is reduce the annual budget deficit, the difference between government revenues (taxes) and expenditures. Reducing the deficit slows the debt growth, allowing the economy to grow and reducing the debt/GDP ratio. So, get used to quoting debt levels in the Trillions. The government is not a household, and household economics do not apply. Remember that interest payments to bondholders also represent income available for economic consumption. When kept at a reasonable level, the debt is also an asset (to paraphrase Hamilton).

What does all of this mean for investors? If history is any guide, not much. Being a deficit hawk in the 1980s would not have served you well if you reduced your portfolio allocation to stocks. Same goes for the 90s, early aughts, and the 2010s.

Does that mean the debt doesn’t matter? Not exactly. There will likely be budget reductions in Congress over the next few years as soon as normal business resumes. (As I write this, the House GOP has finally selected a new speaker, Louisiana’s Mike Johnson). We cut the deficit in the 90s and again after the Great Financial Crisis. We can do it again. The bigger question is when we will have the fortitude and political will to address known funding gaps in Social Security, Medicare, and Medicaid. We know what needs to be done to shore up these essential safety net programs, and the longer we wait, the more costly the fix.

The debt is historically high, and interest payments are poised to rise with higher interest rates. Changes are needed to reduce the deficit and bring the Federal budget more in line with revenues. Does this keep me up at night? No? Do I change my investment thesis because of it? No. Is shutting down the government over raising the debt ceiling a good idea? Never. Do I hope the sensible policymakers will pass spending bills and entitlement reforms to shift the trend? Yes, and I expect it to happen.

See also:

Time to Stop Believing Deficit Bullshit

Time for a 50-Year U.S. Treasury Bond

Last Call for 50-Year Treasury Bonds

Should You Protect Your Portfolio Against a Possible U.S. Debt Default?

The post Should You Be Worried About the US Debt? appeared first on The Belle Curve.