The most common question I get from investors is, “What do you guys think about the market here?”. Whether it is from clients, potential clients, at a family gathering, or at a cocktail party, this is the number one question on every investor’s mind.

I used to dismiss the question and state the obvious – no one has a crystal ball. But I’ve tempered my approach to include an acknowledgement of current market events, valuations, and an economic statistic or two to let the questioner know that I am aware of the current state of affairs. Then I explain that the market can literally go any direction from here and that what happens in the next 6 months or a year is anyone’s best guess. I’m fairly confident that the market will be higher 20 to 30 years from now, so long-term investors are best served not trying to guess short-term movements.

I always end with a nod to exogenous risks – the things we could never see coming such as war, natural disasters, or, as in in recent days, a worldwide health scare. These are the risks we couldn’t read in the tea leaves of economic data if we tried. They cannot be modeled. But they happen, more often than we like to remember.

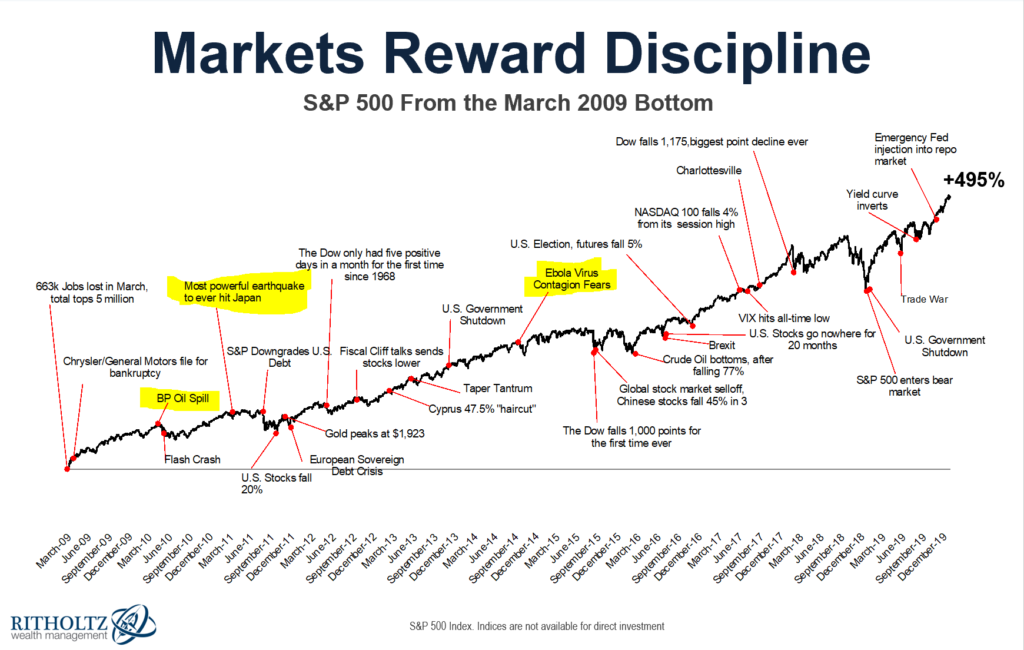

The chart above illustrates a few of the many frightening headline stories since the bottom of the bear market in 2009. I have highlighted three exogenous risks, including another pandemic scare – Ebola.

The BP Oil Spill released 4.9 million barrels of oil into the Gulf of Mexico and is considered one of the largest environmental disasters in U.S. history. I swim and fish in the Gulf and wondered if I’d ever be able to enjoy it again. Driving a few miles offshore, I saw and smelled the oil sheens on top of the water hundreds of miles away from the site of the spill.

The 2011 earthquake and subsequent tsunami in Japan caused a nuclear meltdown of the Fukushima power plant. Nuclear meltdown. Is there anything more frightening than a nuclear meltdown?

The Ebola virus has a mortality rate of somewhere between 50 – 90%. The Ebola outbreak in West Africa between 2014 – 2016 led to an an estimated 28,652 cases, 15,261 confirmed by lab tests, and 11,325 deaths. That is one scary virus.

Remember the Zika virus? I do, I was pregnant with my son at the time and had to skip a conference in Miami after mosquitoes there were confirmed to carry the disease.

It is possible that the Wuhan coronavirus is the next major pandemic that will kill millions of people. I believe it is more likely that global health organizations will figure out how to contain it, eventually creating a vaccine. Since the turn of the 21st century, we’ve seen SARS, MERS, swine flu, bird flu, Ebola, and Zika virus outbreaks. They were all scary. Fear of the unknown is embedded in our DNA, and our initial reaction is panic and flight. This reaction served us well for millions of years, but it is counterproductive to long-term investing.

The number of confirmed cases will continue to grow and dominate headline news for weeks. The Chinese economy will experience a real slowdown as a result of decreased activity. No one had coronavirus in their 2020 market prediction papers last month. That is because it is an exogenous risk, one that cannot be predicted or modeled. Making knee jerk reactions with your long-term investments is a counterproductive measure.

Wash your hands, sneeze into your sleeves, stay home if you have a fever, and if you haven’t already gotten your flu shot, what are you waiting for? The flu kills 10,000’s Americans each year!