What if Your Goal Isn’t the Max?

Many responses to my post on how few families save in 529 plans focused on the inability to max retirement contributions. But what if your goal isn’t to max your 401(k)? I’m sure FIRE movement advocates will disagree, but most people do not need to max their 401(k) to save enough for retirement.

Median household income for those with a bachelor’s degree or higher was $73,500 according to data from the 2003 census. At this level, maxing out a 401(k) at $18,500 is not only near impossible, it’s not even necessary.

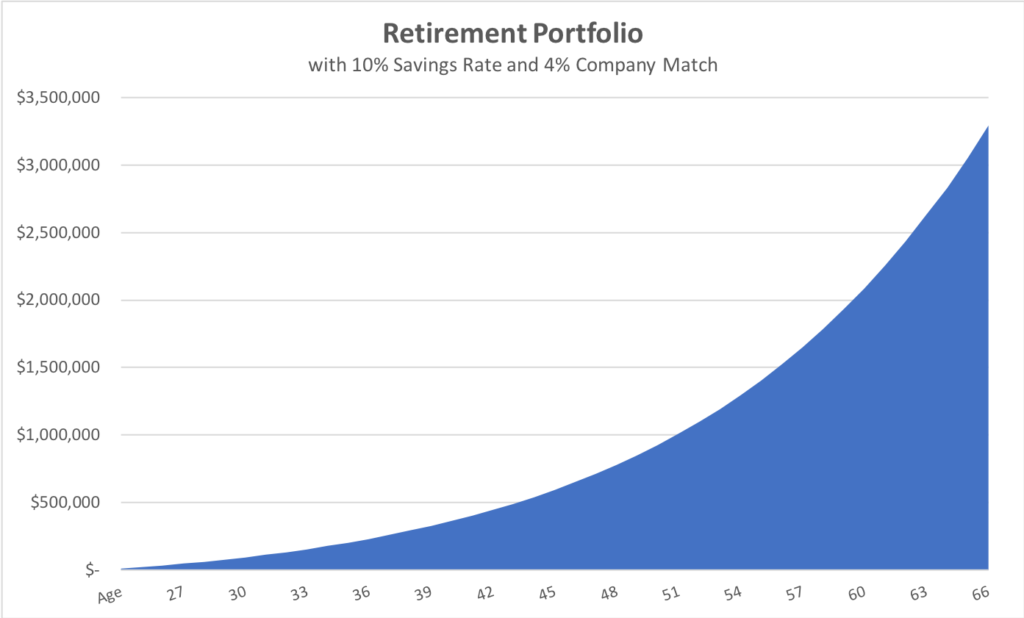

Assume that a household of two recent college graduates earn $73,500 combined. They each work for a company matching 4% of their 401(k) savings, and they each defer 10% of pay to their 401(k) plan. They are savings $7,350 per year, well below the max of $37,000 ($18,500 per person in 2018). In five years, they will have their first child followed by a second child two years later. They both plan to work until their Social Security full retirement age of 67. Market returns will be 7% on average. Inflation is 2%, and their pay and savings increase with inflation.

Under these assumptions, which I concede are too simplistic, they will accumulate $3.3 million in retirement savings. Using the 4% “safe withdrawal” rule of thumb, they will be able take $11,000 month pre-tax from their portfolio in retirement. That’s $4,800/month in today’s dollars. They can also expect a Social Security benefit of $2,900/month under the current program rules. This is enough to sustain their standard of living since they will no longer be saving for retirement or paying FICA payroll taxes.

Bottom line, saving the max is not the goal for this couple. A much lower threshold of savings provides an adequate retirement income stream. Plus they have room to save $200 per month for each child in a 529 college savings account from birth to age 20. This will accumulate $180,000 in college savings in today’s dollars.

Who should save the maximum? If saving 10% – 15% of income is a good rule of thumb (and remember that your employer match counts, too!), individuals earning $123,000 – $185,000 or more should save the max. But starting late has consequences. Those who wait until their 30s, 40s, or 50s to start saving will need to save a much higher percentage of pay. That is why it is important to save early even if the dollar value is small.

Life does not unfold like a straight line analysis on an excel spreadsheet. The couple might withdraw money to put a down payment on a house. One or both parents may take time away from work to care for young children. An economic downturn might lead to layoffs and a period of unemployment. Their future health status is a huge unknown variable.

However, the majority of U.S. households do not need to save the max allowed in 401(k) plan. A savings rate of 10% might be enough for those who start saving in their 20s. Late savers may need to put away 20% or more. But the reality is that most workers do not earn enough to require saving $18,500 (or $24,500 if over age 50) in a 401(k) account every year. While I do not advocate for sacrificing retirement saving to save for college. There is room to save a little in a 529 account, and a little can go a long way is saved consistently over many years.

The post What if Your Goal Isn’t the Max? appeared first on The Belle Curve.