Start Date Randomness

I’ve been the primary advisor to clients for 12 years, and my career in wealth management is approaching two decades. Each client hired me on a different date over those 12 years, and since I joined RWM four years ago, this has been at a pace of about one new client every month. As a result, they all have different start dates for calculating investment performance under my watch. I call this inception date roulette. There’s an element of randomness that determines what the first few months or years of the client’s experience will be in terms of performance since the inception date. I never know when the next downturn in the market will be, but I am certain that a new client will hire me right before it.

Remember in 2011, when the S&P rating agency downgraded the debt rating of the U.S. government? Congress had a standoff over the debt ceiling at the time. Stocks sank 16% over a two-week period. I had just moved from New York to New Orleans and founded a solo advisory business. Guess when my first new client signed on? July 2011. We began that relationship with double-digit declines in their portfolio.

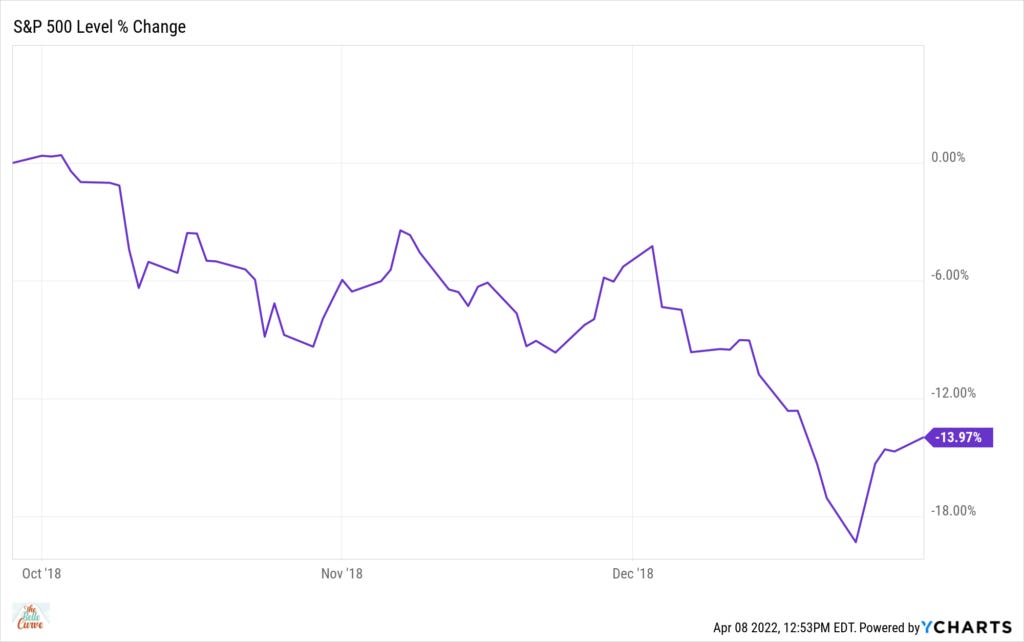

Remember the 20% market decline leading up to Christmas Eve in 2018? The chart below shows the S&P 500 Index performance during the fourth quarter of that year.

I joined RWM in June of 2018 and spent the first few months learning about our firm’s systems, processes, and investment strategies. By the time I began talking to potential new clients, it was late summer. It takes about a month or two from the time we have an initial conversation with a prospect to the time accounts are opened and funded. My first few new relationships were established right before the market sank 20% that fall.

We all remember the COVID crash of March 2020. The market fell 35% in six weeks. That was the most intense market decline I’ve ever experienced. One client joined in early February 2020, immediately before the world shut down.

There’s a flip side to inception date roulette, the client who gets lucky with their timing. Our phones were ringing off the hook during that Covid spring. I chose to cut my maternity leave short to help with the volume. As a result, a handful of clients started in April and May of 2020. In our first year working together, the S&P 500 was up 44%.

My point here is that our investment philosophy and strategy remained the same over these time periods. We didn’t become geniuses in April 2020, and we weren’t idiots in October 2018. These are simply moments in time when the market moved in one direction or another. When it comes to your inception date with an investment advisor, chance plays a huge role.

The same goes for investment strategies going in or out of favor. As I pointed out recently, Warren Buffett, the greatest investor of all time, has had multiple, prolonged periods of underperformance. His style was out of favor, but he stuck to it. And once again, he is reaping the rewards of his discipline. Berkshire Hathaway stock is up 18% year to date while the market is down 5%. So too does any investment style go in or out of favor. Ours is no exception.

I am forever grateful to my mentors for teaching me never to sell based on past investment performance. This might work for hedge fund managers, but it’s recipe for disaster for wealth managers. I have always thrown cold water on excitement over recent outperformance because I know the next downturn is lurking around the bend.

Advisors who sell on performance, die by performance. Their client relationships will not endure the next downturn or the next time their strategy underperforms. Any financial advisor presenting you with a beautiful chart of past performance is a red flag. An advisory relationship should be based on so much more than investment performance alone. If you’ve taken the time to find the right advisor for you, by vetting their philosophy, process, and people, you will be prepared for whatever chance throws your way in the early part of that relationship.

The post Start Date Randomness appeared first on The Belle Curve.