If you were born 200 years ago, there is a good chance you would have succumbed to an infectious disease by now. When European explorers landed in the Americas, their foreign diseases wiped out entire civilizations. A pharmacy in the French Quarter of New Orleans placed yellow liquid in the bottles in the window to discreetly alert citizens in the know that yellow fever was present. Henry VIII survived the plague by retreating to self-isolation, eschewing even the footman for his chamberpot.

Vaccines and antibiotics, which we take for granted, had an enormous impact on human life expectancies. My parents suffered through the measles and the mumps. I passed through the chickenpox right of passage. My children will have none of these diseases. Small pox, yellow fever, and polio no longer threaten to kill or maim us. We are not equipped to fathom the devastation that a brand new virus could cause to our society, and it’s throwing us in a major loop.

“But this time is really, truly, actually different”

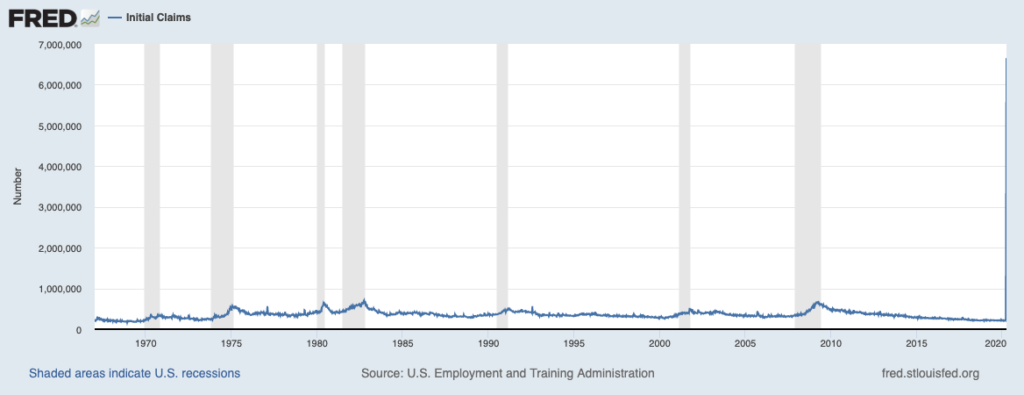

I am hearing this from a lot of people lately, and it is true. No one alive has seen a pandemic on the scale of the COVID-19 coronavirus. The last time anything resembling this pandemic occurred was the Spanish Flu in 1918. At no other time in history has ‘social distancing’, the only tool we have to combat the disease for now, been so destructive to society and our way of life. It is bringing major parts of the global economy to a full and immediate stop. This is no slowdown in economic activity, it is a cliff. In the past two weeks, 9.9 million Americans have filed for unemployment benefits. This exceeds the 8.8 million jobs lost during the entire financial crisis. In just two weeks.

Initial jobless claims are literally off the charts.

Restaurants, airlines, hotels, bars, and retail stores are experiencing an immediate evaporation of business and revenue. The bartender who cannot pay rent means the landlord cannot make a mortgage payment, which puts stress on the financial sector, and so on and so forth. This is the first ‘no fault’ recession in modern times. A completely exogenous risk has put a full stop of entire sectors of the world economy. It is truly extraordinary to witness in real time.

Yes, this time is different.

But here’s the thing.

They all are.

In September of 2001, terrorists flew commercial passenger planes in to the World Trade Center buildings, knocking both of them down. America had not been attacked on home soil since Pearl Harbor. New Yorkers lived in daily fear that the next attack was imminent. Millions of Americans refused air travel for months, if not years, afterwards. Do you remember the armed military guards in the subway? They were still there when I moved to Manhattan four years later.

In the fall of 2008, the entire financial system was on the verge of collapse. Those working outside the financial industry often fail to understand the severity of the situation. At one point, I seriously considered whether paychecks and access to bank accounts would vanish completely as commercial paper markets locked up, Lehman crashed into bankruptcy, and the government took over Fannie and Freddie.

I won’t even describe what happened during World War 2.

The passage of time has caused our memories of these events to blur. Hindsight allows us to see that we made it through past crises. While in the middle of a crisis, we do not have that luxury.

There are many unknowns about the impact and length of the coronavirus pandemic. Some companies and potentially entire industries may not return. The way we work, learn, and interact with others may be changed forever. We will have to see it through to know how the story ends.

But one thing remains constant throughout time. Humans are both fearful and greedy, and human nature has not changed. You can bet that the market will be ahead of the news on coronavirus and detect economic recovery before it shows up in the data.

They are called crises for a reason. Orderly, calm economic recessions do not exist, and if they did, there wouldn’t be any selling.