Almost everyone is suffering financially from the Covid-19 coronavirus pandemic. Nonessential businesses across the country are shuttered. More than 22 million Americans have filed for unemployment claims over the past four weeks. Hotel rooms are empty as municipalities reliant on their taxes see holes blown in their budgets. Cuts to city services, furloughs, and layoffs of public employees are sure to follow. Weddings, church services, concerts, sporting events, and conferences are cancelled for months. There is great uncertainty about when and how the economy will reopen and trudge towards normalcy again.

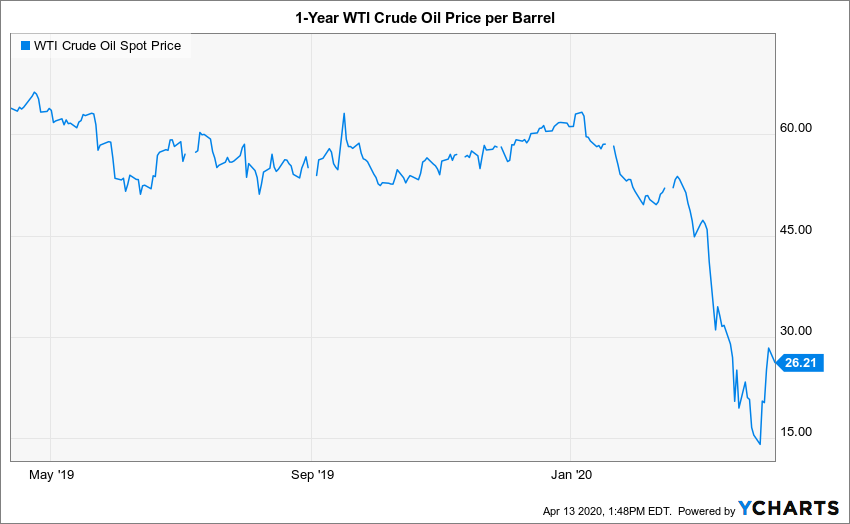

Stocks sold off dramatically, and March was the most volatile month for US stock markets on record; a record that includes the Great Depression. Demand for oil plummeted as Americans stayed home, drove less, and cancelled all travel plans. Meanwhile, Russia and Saudi Arabia had a spat over oil production cuts and continued to pump unneeded oil out of the ground. The healthcare industry is not immune. Elective surgeries have been cancelled, and no one wants to visit their doctor’s office for a well visit. Dentists are at the most risk of contracting coronavirus and are closed except for emergencies.

Our economic system is so intricately connected that we have only just begun to see the ripple effects from these drastic moves. The food delivery system for restaurants is not equipped to sell products in grocery store sized packaging. Milk has been dumped and dairy cows slaughtered. The chicken industry prepared for seasonal chicken wing demand at March Madness, and now there’s a glut of spoiled chicken wings. Dutch tulips are going straight in to the garbage. It is a mess out there.

But this economic whiplash is no one’s fault.

You cannot fault restaurants for failing to plan for a complete, multi-week (perhaps month) shutdown. Nor can you do the same for any business that was completely shut down to slow the spread of a brand new virus for which we have no immunity, no treatment, and no vaccine. The full stop on certain segments of economic activity looks nothing like a recession or seasonal slowdown. No new restaurant could ever open or operate if required to maintain 3-6 months of operating expenses in case of a pandemic. In a hyper competitive industry with razor thin margins, that cash has to be reinvested in to the business.

There is a desire to blame elected officials and government entities for our response to the coronavirus pandemic. But this was always a losing proposition for government leaders. Close businesses and schools too early, and you have very few cases of coronavirus. Everyone blames the leader for overreacting. Wait too long and the virus spreads exponentially, overrunning the healthcare system. The U.S. is not the only country caught off guard by this pandemic. Many developed nations with good healthcare systems are struggling alongside us. It is too soon to know what we could have done differently. What matters is that we are fighting it now, and we will win, eventually.

The financial devastation we are witnessing can only be solved with a government-led response. The Federal Reserve announced unlimited support of market liquidity. This is not a bailout. It is a critical function that keeps financial markets functioning properly. Congress passed a massive stimulus bill that included direct payments to individuals, increased unemployment benefits, and assistance for businesses. None of this should be considered a bailout because no one is at fault here. Businesses did not take unnecessary risk by virtue of existing during the coronavirus pandemic of 2020. There is no moral hazard in extending payroll assistance to small businesses to keep their employees.

There are many lessons to be learned from the coronavirus pandemic. The modern world ignored past brushes with infectious disease and was lulled into a sense of security by victories over SARS, MERS, H1N1, and Ebola. Bill Gates and epidemiologists tried to warn us. Our only option now is to fight our way out of this mess. That includes using the extraordinary resources of our federal government, Treasury, and central bank. There are few problems better solved by such a massive governmental response.